Jeff Koinange was deeply affected by economic impact of Covid-19 pandemic, he nearly lost his Kitisuru home which was put up on auction after he defaulted Ksh130 million bank loan.

The Citizen TV nearly became homeless after his two mansions in the leafy Kitisuru neighborhood were put up on sale for defaulting on the loan he took.

The veteran journalist bought two property in Kitisuru which are adjustment to each, they are currently valued at Ksh100 million each.

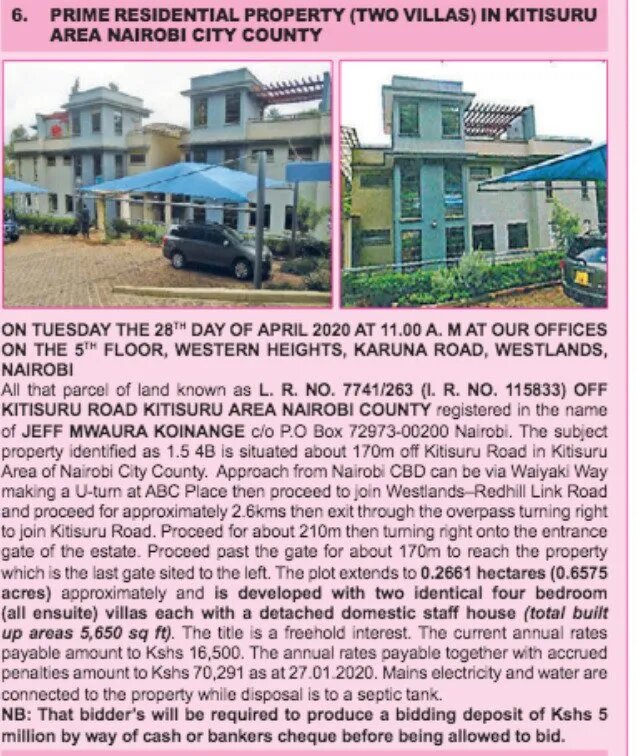

The two four-bedroom villas in the high-end residential area sit on 0.67 acres and are each attached with a servant’s quarter.

Jeff Koinange stays in one of the villas while the other one he initially used it to store his art pieces before he decided to rent it.

In April 2020, the Citizen TV anchor struggled to hold onto his multimillion shillings Kitisuru property after NCBA bank decided to auction it over a default loan.

NCBA bank was seeking to recover at least Ksh65 million from the sale of each of the two villas over a debt that fell into default in 2019.

The lender contracted Garam Investments to auction Jeff Koinange’s two villas, the auction was supposed to take place on April 28th 2020.

Garam asked those seeking to buy the two villas through the public auction to place a deposit of Ksh5 million ahead of bidding for the prime homes.

“The title is a free hold interest. The current annual rates payable amount to Sh.16,500. The annual rates payable together with accrued penalties amount to Sh.70,291 as at 27.01.2020,” the advert on the auction by Garam Investments read in part.

Jeff Koinange was however able to save his two villas from the auctioneer’s hammer. He struck a deal with NCBA to stop the auction shortly after the auction was advertised on local dailies.

It emerged that the Citizen TV anchor reached out to President Uhuru Kenyatta for help when he was about to lose his Kitisuru property.

The Kenyatta family control about 13.2% stake at NCBA bank, their stake is valued at Ksh6.6 billion.

NIC Group and CBA Group merged in 2019 to form NCBA group. NIC Group shareholders own 47% of the merged entity and CBA shareholders, including the Kenyatta family, own 53% of the merged entity.

Jeff Koinange used his closeness to President Uhuru to save his family home from being auctioned by NCBA bank.

President Uhuru and Jeff Koinange have deep family connections besides their friendship. The late minister Mbiyu Koinange, who is Jeff Koinange’s uncle, was Jomo Kenyatta’s brother-in-law and confidant, who also became the first Kenyan to attain university education.

Jeff’s father, Fredrick Mbiyu Koinange, was the first African Kenyan to open a car dealership in 1948 and Kenya’s first indigenous petrol station in 1966, the same year he passed on.

President Uhuru and Jeff Koinange also went to the same school – St Mary’s School. The head of state was however a few classes ahead of the Citizen TV anchor.

In an interview on Kiss FM after Uhuru Kenyatta was elected president for the first time in 2013, Jeff joked that the head of state bullied him at St Mary’s School.

He recalled how Uhuru Kenyatta hit him on the head during a game they referred to as ngoto.

“Boss, Uhunye alinihanda ndani ya minibus ya shule bwana (Uhuru used to bully me in the school minibus). Can you imagine that he is now the President,” said Jeff Koinange.